Business Insurance in and around Stuarts Draft

One of the top small business insurance companies in Stuarts Draft, and beyond.

Insure your business, intentionally

Help Protect Your Business With State Farm.

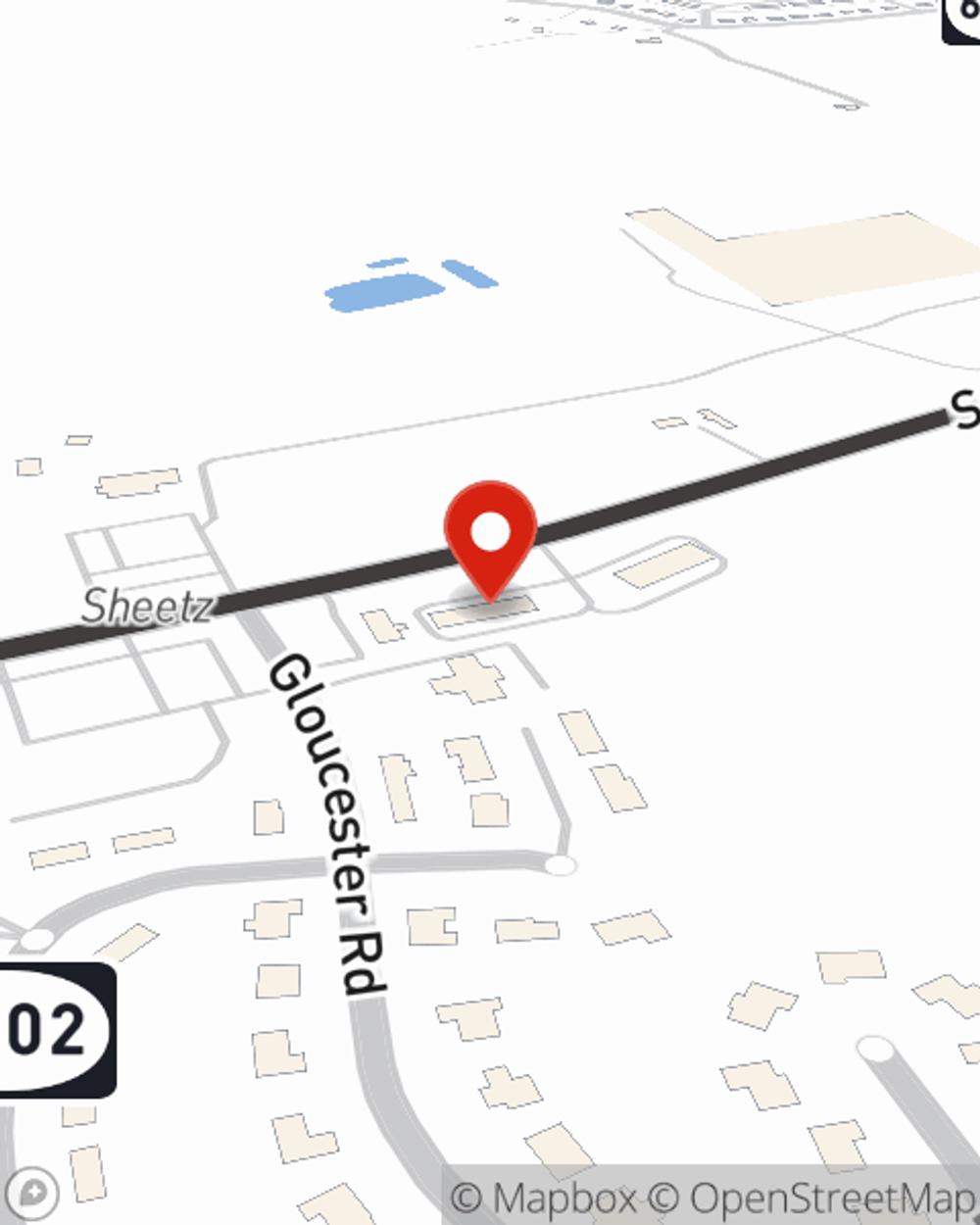

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Dave Shelor help you learn about excellent business insurance.

One of the top small business insurance companies in Stuarts Draft, and beyond.

Insure your business, intentionally

Surprisingly Great Insurance

For your small business, whether it's a fabric store, a pottery shop, a HVAC company, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like buildings you own, business liability, and business property.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Call or email State Farm agent Dave Shelor's team today to discover your options.

Simple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Dave Shelor

State Farm® Insurance AgentSimple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.